Go to Economics

Topics

Table of Contents

Introduction

- Roles and objectives of central banks

- Tools used to implement monetary policy and the monetary transmission mechanism

- Qualities of an effective central bank

- Monetary policy objectives: inflation, interest rate, exchange rate targeting Interaction of monetary and fiscal policy

Role of Central Banks

Roles of Central Banks and Objectives of Monetary Policy

- Monopoly supplier of the currency: Central banks are the only authority to print money.

- Banker to the government and the banker’s bank: Central banks provide banking services to the government and other banks in the economy.

- Lender of last resort: Central banks supply funds to banks that are facing a shortage and helps prevent a run on the bank.

- Regulator and supervisor of the payments system: Oversees, regulates and sets standards for a country’s payments system for millions of transactions that happen on a daily basis. It also coordinates with other central banks around the world to formulate processes.

- Conductor of monetary policy: Takes actions to control or influence the quantity of money and credit in an economy.

- Supervisor of the banking system: This varies from one country to another. But, in many countries, the central bank along with one/more regulatory authorities oversees the banking system including granting licenses for a new bank, etc.

- Manage foreign currency reserves and gold reserves: The central bank may decide to sell foreign currency from its reserves if its domestic currency is under sustained pressure and continues to depreciate quickly.

- The Reserve Bank of India (RBI) repeatedly sold dollars in 2012 to boost the INR.

The Objectives of Monetary Policy

Central banks normally have a variety of objectives (i.e., to maintain full employment and output, to maintain confidence in the financial system, or to promote understanding of the financial sector), but the overriding one is nearly always price stability or keeping inflation in check.

Monetary Policy Tools and Monetary Transmission

The three tools available to central banks to control the money supply are: open market operations, refinancing rates and reserve requirements.

Open Market Operations

- Increase or decrease the amount of money in circulation.

- Increase money supply by buying government bonds from commercial banks → increases the reserves of private banks → lends this money to firms and households, which then multiplies.

- Decrease money supply by selling government bonds to commercial banks → this decreases private banks’ reserves to lend money to firms and households.

The Central Bank’s Policy Rate

- Official interest rate: Objective is to influence short and long-term interest rates.

- Repo rates: Rate at which the central bank is willing to lend money to commercial banks. The way it achieves this policy-rate setting is through a repurchase agreement wherein the central bank sells a security to commercial banks with a commitment to repurchase after a certain number of days. The maturity varies from overnight to two weeks; these are short-term collateralized loans. The rate implicit in this agreement is called repo rates.

- Base rates: This is the rate at which commercial banks are willing to lend to each other.

- Federal funds rate: This is specific to the U.S. It is the interbank lending rate on overnight borrowings of reserves.

- If the policy rate is high, the amount of lending will decrease and the quantity of money will decrease.

- Else, the amount of lending will increase and the quantity of money will increase.

Reserve Requirements

The central bank may change the money supply in the economy by changing the reserve requirement.

- If the reserve requirement is low, then the money creation process is enhanced and the money supply increases.

- Else, the money creation process is restricted and the money supply decreases.

The Transmission Mechanism

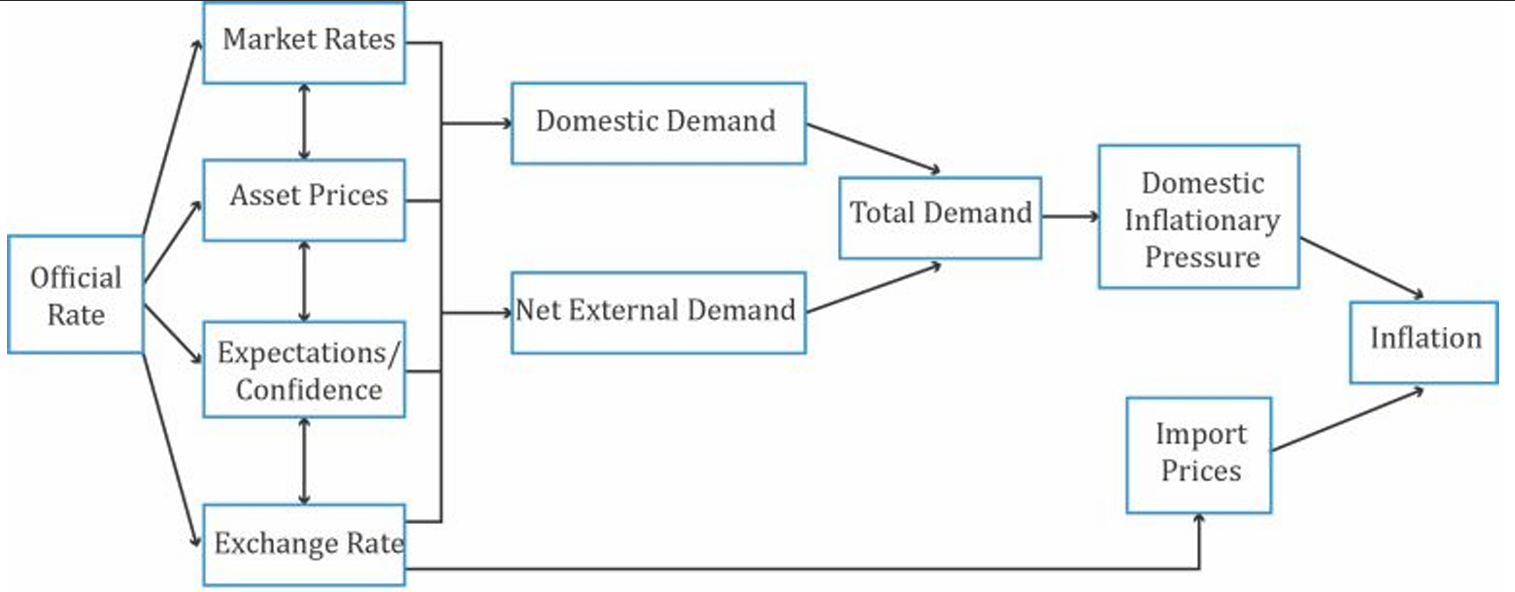

How policy decisions (especially the policy rate) transmits across the economy and affects the price level. One of the notable points from the previous section was that the policy rates set by central banks are short-term in nature, ranging from overnight to a few weeks. So, how does it affect the economy (growth, employment) in the long run?

For simplicity, let us break it down into three parts.

1. Link between the changes in official rates on other related markets interrelated channels

To restrict money supply, the central bank may decide to increase official interest rates. This affects four interrelated channels:

- Market rates: An increase in official interest rates is reflected in short-term bank lending rates. Once the policy rate goes up, banks increase the base rates, which in turn affect the rates at which banks lend to customers (mortgages, loan rates).

- The rates on savings deposits also change, but not by the same amount as banks maintain a difference between deposit and loan rates.

- Asset prices: Market value of securities such as bonds and equities decrease when the official interest rates rise. In the case of bonds, prices are inversely related to long term interest rates.

- Securities prices also decrease because future cash flows are discounted by a larger factor.

- Expectations/confidence: Increase in rates could influence (dent) expectations about the future prospects of the economy, such as employment opportunities, firms’ profitability, unemployment levels, etc. A rate increase may also imply the economy is growing faster than expected. Or, it could mean it is time to slow the growth in the economy and tame inflation, which would in turn lower confidence.

- Exchange rate: The exact impact is uncertain. But, an unexpected increase in official rate will lead to an appreciation of the domestic currency. A stronger domestic currency makes exports unattractive to overseas buyers as it is more expensive in their currency terms. This would lower the exporters’ profitability.

Impact on individuals/households: Discourages borrowing, reduces spending, postponing consumption.

- Discourages consumer spending. Individuals tend to postpone consumption and are more inclined to save, if rates increase.

- The tendency to borrow to consume will also be low because of higher rates and interest rate expectations. If further rate increases are anticipated, then consumers will not borrow.

- Disposable incomes of individuals decrease as prices increase.

- The fall in asset prices affects their financial wealth. Higher rates → mortgage rates higher → lower demand → fall in market prices of houses.

- The outflow for those with mortgages increases.

- Makes domestic goods expensive relative to foreign goods. There may be a tilt in spending with more being spent on imported goods.

Impact on firms: Depends on the cost of capital.

- Higher borrowing costs.

- Reduced profitability.

- Deferred new projects, investment spending, and hiring plans.

2. Impact on aggregate demand

- Changes in consumption and investment spending behavior of consumers and firms affect aggregate demand.

- Low confidence → low spending → low demand.

- Increase in rate reduces real domestic demand and net external demand (difference between export and import consumption).

- Total aggregate demand decreases.

3. Impact on inflation

- Determines the nominal value of goods and services in the long run.

- Weaker demand may put a downward pressure on inflation.

Monetary Policy Objectives

Inflation Targeting

Some economies implement monetary policy by targeting a certain level of inflation and then ensuring this level is met by monitoring a range of monetary and real economic indicators.

The success of inflation targeting depends on the following three factors that assess the effectiveness of a central bank:

Independence (free from political interference)

- The degree of independence varies across economies.

- Some are operationally and target-independent, i.e., they determine the level of inflation to target, how to meet that target, and by when it must be achieved.

- There are others where the bank is assigned a rate of inflation to target by the government. So, they are only operationally independent.

Credibility

- Follows through on its stated policy intentions.

- Is the central bank independent and does the market/public have confidence in the policy measures?

Transparency

- Clear policy on economic indicators: Is the central bank transparent about its decision-making process?

- Being transparent in its quarterly assessment is one of the ways to gain credibility.

- What are the indicators the bank monitors before making the interest rate/policy decision?

Other features of an inflation-targeting framework include:

- A decision-making framework that considers a wide range of economic and financial market indicators.

- A clear, symmetric, and forward-looking medium-term inflation target, sufficiently > 0%, to avoid the risk of deflation, but low enough to ensure a significant degree of price stability. Similarly, it should not be too high either, because a high rate would result in price instability and inflation volatility.

- Inflation targets for several economies are usually between 2% and 3%.

For instance, if a country sets the target to 0.5% and misses it, then it runs the risk of deflation (or negative inflation).

- The inflation target set by central banks can become self-fulfilling prophecies if economic agents believe the target will be met. Wage negotiations will factor in this level of inflation.

The following are some of the obstacles in successful implementation of monetary policy in developing economies:

- Rapid financial innovation.

- Absence of liquid government-bond market.

- Lack of independence of central banks.

- Rapidly changing economy.

- Poor track record in controlling inflation in the past.

Exchange Rate Targeting

Instead of targeting inflation, some economies implement monetary policy by targeting the exchange rate. It is done by setting a fixed level or band of values for the exchange rate against a major currency.

How it works:

- Central bank announces the target.

- Central bank supports the target by buying and selling the national currency in foreign exchange markets.

- By tying the domestic economy’s currency to another economy with a good track record of inflation, the domestic economy would effectively “import” the inflation experience of the low inflation economy.

- Interest rates and conditions in the domestic economy must adapt to accommodate this target and domestic interest rates and money supply can become more volatile.

The central bank of Brazil announces that it wishes to maintain a specific exchange rate against the U.S. dollar. Brazil, being a developing economy, faces volatile inflation.

- If inflation is higher than the U.S.’s, then its currency, the Real, falls against the USD.

- To arrest its fall, Brazil’s central bank would sell dollar reserves and buy Reals.

- It restricts the money supply and increases short-term interest rates.

- In contrast, if the inflation was low, and the Real appreciates against the USD, then the central bank would have to buy USD and sell Real.

In a pegged exchange rate, a country fixes the value of its currency against either the value of another single currency, a basket of other currencies, or another measure of value, e.g., gold.

In dollarization, a country uses US dollar as its functional currency.

What you cannot do because of exchange rate targeting:

- Monetary policy is not independent.

- Monetary policy cannot be used to target domestic inflation.

Contractionary and Expansionary Monetary Policies and Their Limitations

Central banks control liquidity by adjusting policy rates.

Contractionary monetary policy:

- High economic growth leads to high inflation. To cool off the economy, a central bank may employ a contractionary monetary policy.

- The central bank does this by increasing the official policy rate. This restricts the growth rate of money supply and the real economy contracts.

Expansionary monetary policy:

- To boost a slowing economy, the central bank decreases the official policy rate. This increases liquidity and growth rate of money supply and the real economy expands.

- This is only in the short-run. Given the money neutrality theory, increasing or decreasing interest rates will not affect the real economy in the long-run.

High and low policy rate is with respect to the neutral rate of interest:

- It is the rate of interest that neither spurs nor slows the economy.

- If policy rate > neutral rate, then the monetary policy is contractionary.

- If policy rate < neutral rate, then the monetary policy is expansionary.

What’s the Source of the Shock to the Inflation Rate?

The central bank must consider the source of inflation before deciding on contractionary/expansionary policy action.

Two sources of shock to the inflation rate are:

- Demand shock: Caused by an increase in consumer confidence, which leads to more consumption and investment spending. Raising interest rates to control inflation is apt here.

- Supply shock: Caused by an increase in a supply factor such as oil prices. Raising interest rates is not appropriate as consumption will tend to fall, and consequently there will be an increase in unemployment.

Limitations of Monetary Policy

The will of the monetary authority does not necessarily transmit seamlessly through the economy.

This is because central banks cannot control:

- The amount of money households and corporations put in banks on deposits.

- The willingness of banks to create money by expanding credit.

It is relatively easy for central banks to influence short-term rates but long-term rates depend on expectations of interest rates and are not easy to control.

Quantitative easing is an unconventional monetary policy used when the traditional policy becomes ineffective. It is used to increase money supply where the central banks print (these days electronically) money to buy any assets.

Interaction of Monetary and Fiscal Policy

Both monetary and fiscal policies are used to stabilize an economy. But the impact of one varies based on the other’s stance, and their interaction, as illustrated in the table below:

- Effect of fiscal policy

- Easy → AD up

- Tight → AD down

- Effect of monetary policy

- Easy → Low rates

- Tight → High rates

- Effect on economy

| Easy Fiscal | Tight Fiscal | |

|---|---|---|

| Easy Monetary | Private sector demand up. Growing private and public sector. |

Private sector stimulated. Public sector become a smaller %. |

| Tight Monetary | Private sector down. Public sector become a higher %. |

Private sector demand down. Shrinking private and public sector. |

Factors Influencing the Mix of Fiscal and Monetary Policy

- To increase overall output, private investment spending is important. For this, monetary policy with low interest rates and tight fiscal policy works best.

- If infrastructure is poor and there is a lack of skilled labor, then an expansionary fiscal policy and loose monetary policy works best, but at the risk of inflation.

- Fiscal loosening methods that can be reversed after a specific time period include:

- Social transfers to households.

- Decrease in income tax.

- Increase in government spending.

- Increase in transfers to poor people.

- Monetary policies that will go with the above fiscal policies for the same duration include:

- No monetary accommodation → Any increase in AD will lead to increase in interest rates.

- Interest rates stay unchanged for the duration when the fiscal policy is implemented and reversed.

Quantitative Easing and Policy Interaction

An unconventional approach adopted by the US and UK governments during the recent recession of 2008-09 to print money.

As interest rates were already near zero level, there was no option of reducing it further to stimulate growth.

The central bank (printed money and) bought trillions of dollars’ worth of government bonds to increase money supply in the system, increase expenditure, and avoid deflation.

The Importance of Credibility and Commitment

According to the IMF model, when governments run persistently large budget deficits, real interest rates rise, crowding out private investment and reducing each country’s productive potential.

As people realize that deficits will persist, inflation expectations and long-term interest rates rise, reducing the stimulus’s effect by half.