Go to Economics

Topics

Table of Contents

Introduction

Geopolitics is the study of how geography affects politics and international relations.

Under geopolitics, analysts study actors—the individuals, organizations, companies, and national governments that engage in political, economic, and financial activities—and how they interact with one another.

Geopolitical risk is the risk associated with tensions or actions between actors that affect the normal and peaceful course of international relations.

Geopolitical risk could arise due to a change in policy, a natural disaster, a terrorist act, a theft, or war.

Investors study geopolitical risk because it can have a tangible impact on investment outcomes. This learning module provides a framework by which investors can measure, assess, track, and react to geopolitical risk, in order to improve investment outcomes.

National Governments and Political Cooperation

Actors can be split into two types:

- State actors: National governments, political organizations, or country leaders that exert authority over a country’s national security and resources. Eg. British PM, Malaysia's Parliament

- Non-state actors: Entities that participate in global political, economic, or financial affairs but do not directly control national security or country resources. Eg. NGOs, MNC, Charities

Features of Political Cooperation

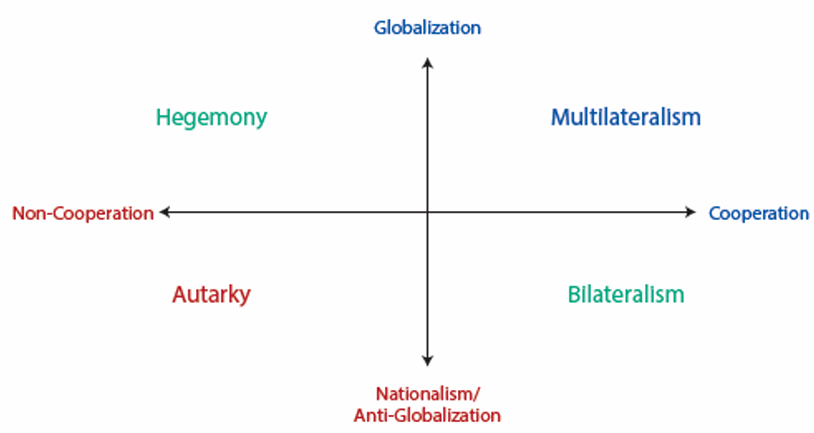

At the highest level, the relationship between state actors can be cooperative or competitive.

Cooperation is the process by which countries work together toward some shared goal or purpose. These goals may vary widely from strategic or military concerns to economic influence or cultural preferences.

One specific type of cooperation – political cooperation – refers to the extent to which countries work toward agreements on rules and standardization for the activities and interactions with one another.

- Cooperative country: A country that engages and reciprocates in rule standardization; tariff harmonization; international agreements on trade, immigration, or regulation; and allows free flow of information, including technology transfer.

- Non-cooperative country: A country with inconsistent and even arbitrary rules; restricted movement of goods, services, people, and capital across borders; retaliation; and limited technology exchange.

Motivations for Cooperation

There are many reasons why a country may want to cooperate with its neighbors or with other state actors.

National Security or Military Interest

National security is the protection of a country, its citizens, economy, and institutions from external threats. These threats can range from military attacks to terrorism, crime, cyber-security, and even natural disasters.

Geographic factors influence a country’s approach to national security and the extent to which it will choose a cooperative approach.

- Landlocked countries rely heavily on their neighbors for access to vital resources. Because of this reliance, cooperation is important for sustaining international access and growth, or even for survival.

- Countries that are well-connected to trade routes, or countries acting as a conduit for trade, may use their geographic location as a lever of power.

Economic Interest

The concept of national security has evolved over time to include economic factors such as access to resources like energy, food, and water.

Countries that choose to cooperate in support of their economic interests are most likely interested in one of two things:

- Either securing essential resources through trade

- Levelling the global playing field for their companies or industries through standardization.

Resource Endowment, Standardization, and Soft Power

Geophysical Resource Endowment

It includes factors such as livable geography and climate, as well as access to food and water, all of which are required for sustainable growth.

It varies greatly among countries. Some countries are relatively self-sufficient in their resource use. While some countries rely heavily on others for key factors of production, such as fossil fuels.

These differences create power dynamics that can influence the terms of engagement between states.

Standardization

Standardization is the process of creating protocols for the production, sale, transport, or use of a product or service. Standardization can aid in the expansion of economic and financial activities across borders, benefiting all parties who agree to follow these protocols together.

The different types of rules standardization are:

- Regulatory cooperation

- Process standardization

- Operational synchronization

| Regulatory Cooperation | Process Standardization | Operational Synchronization | |

|---|---|---|---|

| Challenge | As cooperation expands, countries need a standard for governance of the banking sector. | Transactions across borders faced higher costs and longer wait times, increasing the burden for cross-border activity. | Increasing international trade created supply chain bottlenecks as containers of different sizes and shapes were sent to ports worldwide. |

| Solution | Basel Committee on Banking Supervision (BCBS) | Society for Worldwide Interbank Financial Telecommunication (SWIFT) | Containerization |

| Process | Established in 1974 by the G10 banking authorities → G20 | Established in 1973 to provide a global financial infrastructure. | Standards set for containers of uniform size and shape using multi-modal forms of transport and port cranes. |

| Benefit | Effective supervision of the global banking sector and international capital flows. | Facilitates global payments in more than 200 countries and territories, servicing more than 11,000 institutions worldwide. | Dramatically reduces the time and cost of shipping goods. |

Cultural Considerations and “Soft Power”

Some countries may cooperate with others for cultural reasons such as: long-standing political ties, immigration patterns, shared experiences, or cultural similarities.

Some countries may engage in soft power – which is a means of influencing another country’s decisions without force or coercion. Soft power can be built over time through actions such as cultural programs, advertisement, travel grants, and university exchange.

South Korea promotes visiting Seoul (its capital) in subway systems around the world. These advertisements use popular Korean-made products, musical acts, and actors to encourage interaction with Korean culture and business.

The Role of Institutions

An institution is an established organization or practice in a society or culture.

An institution can be a formal structure, such as a university, organization, or process backed by law; or, it can be informal, such as customs or behavioral patterns important to a society.

Strong institutions generally contribute to more stable internal and external political forces. This stability provides a country more opportunity to develop cooperative relationships.

Hierarchy of Interests and Costs of Cooperation

A country’s national interest can be thought of as a hierarchy of factors. Those essential for survival are at the top and nice-but-not-essential elements are lower down.

Governments use the hierarchy of interests to guide their behavior. They will choose to cooperate where it benefits the nation-state, but when two needs result in conflicting cooperation tactics, those higher up the hierarchy take precedence.

Two countries engaged in a military conflict may not cooperate on tariff harmonization, even though tariff harmonization may benefit both countries on a stand-alone basis.

Power of the Decision Maker

The length of a country’s political cycle can influence its hierarchy of national interests. Many countries have political cycles of only a few years, making it difficult to prioritize long term risks such as climate change or addressing income inequality over projects or goals that can be accomplished in a short period of time.

Decision makers, such as political parties or individuals, may have their own set of influences or needs, which can affect a country’s cooperative and non-cooperative choices.

Political Non-Cooperation

Political cooperation and non-cooperation exist on a spectrum. While it is in some countries’ interest to be highly politically cooperative, for others it is less essential. There are some cases of extreme non-cooperation—countries whose political autonomy is more important than the benefits of any cooperative actions.

Forces of Globalization

Globalization is the process of interaction and integration among people, companies, and governments worldwide. It has led to the spread of products, information, jobs, and culture across borders.

Features of Globalization

Globalization is primarily carried out by non-state actors, such as corporations, individuals, or organizations, and is the result of economic and financial cooperation.

Globalization is marked by economic and financial cooperation, including the active trade of goods and services, capital flows, currency exchange, and cultural and information exchange.

By contrast, anti-globalization or nationalism is the promotion of a country’s own economic interests to the exclusion or detriment of the interests of other nations. Nationalism is marked by limited economic and financial cooperation.

Motivations for Globalization

Globalization provides the following potential gains to non-state actors (such as companies and investors):

- Increased profits:

- Profits can be increased by increasing sales. Globalization allows companies to access new customers for their goods and services.

- Another way to boost profits is to reduce costs. Globalization allows companies to access lower-tax operating environments, reduce labor costs, and seek other supply chain efficiency gains.

- Access to resources and markets:

- Companies need sustainable access to resources such as talent or raw materials. If these resources are not readily available or affordable in their home country, then companies may globalize to improve access.

- Some investors may seek investment opportunities in foreign markets. In this context, there are two important types of flows.

- Portfolio investment flows are short-term investments in foreign assets, such as stocks or bonds.

- Foreign direct investments (FDI) are long-term investments in the productive capacity of a foreign country.

- Intrinsic gain:

- Intrinsic gain is a side effect or consequence of an activity that generates a benefit beyond profit itself.

- Personal growth or education that people can obtain by broadening their horizons, visiting new places, or learning new ideas.

Costs of Globalization and Threats of Rollback

Globalization also has some potential disadvantages, such as:

- Unequal accrual of economic and financial gains: Although globalization generally improves aggregate economic activity, this does not imply improvement for everyone.

- Lower ESG standards: Companies that operate in lower-cost countries often adhere to the local standards of those countries. If the ESG standards in one country are lower as compared to another, and companies follow the lower standards, then globalization can create a drain on human, administrative, and environmental resources.

- Political consequences: While some countries may benefit from increased labor force utilization, others may lose jobs as companies relocate. It has the potential to exacerbate income and wealth inequality, as well as differences in opportunity within and between countries.

- Interdependence: Due to globalization companies may become dependent on other countries’ resources for their supply chains. If there is a disruption to the supply chain, then companies may not be able to produce the good themselves.

International Trade Organizations

International Monetary Fund

Primary responsibilities of the IMF: To ensure the stability of the international monetary system, the system of exchange rates, and international payments that enables countries to buy goods and services from each other.

- Provides a forum for cooperation on international monetary problems.

- Facilitates the growth of international trade and promotes employment, economic growth, and poverty reduction.

- Supports exchange rate stability and an open system of international payments.

- Lends foreign exchange to members when needed, on a temporary basis and under adequate safeguards, to help them address balance of payments problems.

How does the IMF ensure global economic stability?

- Financial assistance:

- The IMF stands ready to lend foreign currencies to member countries to assist them during periods of significant external deficits.

- A pool of gold and currencies contributed by members provides the IMF with the resources required for these lending operations.

- Following the 2007-09 crisis, the IMF has enhanced its lending facilities and member countries’ access to fund resources.

- Surveillance:

- In the wake of several financial crises in the recent past (downgrading of Greek sovereign debt to non-investment grade and its cascading effects on other EMU countries such as Italy, Spain, etc.), the IMF has improved its monitoring of global, regional, and country economies on macroeconomic policies.

- Helping resolve global economic imbalances.

- Technical assistance:

- Offers training to country officials on how to design and implement effective macroeconomic policies, and how to manage their financial systems and capital markets.

World Bank Group

The World Bank’s main objective is to help developing countries fight poverty and enhance environmentally sound economic growth.

One of the current goals of the World Bank to achieve by 2030 is to end extreme poverty by decreasing the percentage of people living on less than $1.25 a day to less than 3%.

The World Bank funds projects in developing countries and provides financial and technical expertise with an objective to reduce poverty. It finances these projects through its two affiliated entities, IBRD and IDA. Both these organizations provide low or no interest loans to countries that have unfavorable or no access to international credit markets.

International Bank for Reconstruction and Development (IBRD): The primary source of funding for the bank is by selling AAA-rated bonds in the world’s financial markets. It has enjoyed this high rating since 1959. IBRD’s reserves have been built up over the years with the capital contributed by the bank’s 188 member countries. It generates income from lending out its own capital. IBRD’s income pays for the World Bank’s operating expenses.

International Development Association (IDA): The world’s largest source of interest-free loans and grant assistance to the poorest countries.

World Trade Organization

The WTO is the only organization that deals with the rules of trade between nations. The most important functions of the WTO include:

- Implementation, administration, and operation of individual agreements. All the major decisions are taken by the representatives of the governments who meet regularly in Geneva.

- Acting as a platform for negotiations such as lowering customs tariffs, removing trade barriers, etc.

- Settling disputes: If the countries feel there has been an infringement of an agreement, or any other dispute, then the issue is settled by the WTO.

- Building trade capacity: WTO helps developing countries to build the skills and infrastructure needed to boost their trade.

- WTO agreements have been signed by a large majority of the world’s trading nations and ratified in their respective parliaments.

- Mandate to review and propagate its members’ trade policies and ensure the coherence and transparency of trade policies through surveillance in a global policy setting.

Assessing Geopolitical Actors and Risk

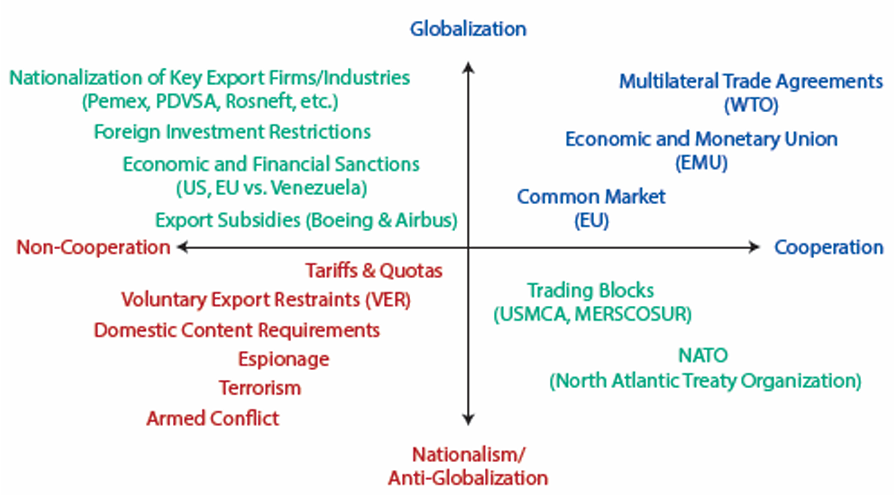

In general terms, regions, countries, and industries that are more reliant on on cross-border goods and capital flows will have higher levels of cooperation.

The interdependent nature of globalization may reduce the likelihood that collaborative countries levy economic, financial, or political attacks on one another. However, that same interdependence can make cooperative actors more vulnerable to geopolitical risk than those less dependent on cooperation and trade.

For geopolitical risk analysis, it is important to consider not only which quadrant a country currently occupies, but also its stability within that quadrant. A hegemon working to strengthen political cooperation may pose less of a threat to investment outcomes than a multilateral actor attempting to undermine them.

Autarky

Autarky refers to countries that seek political self-sufficiency with little or no external trade or finance. Strategic domestic industries are controlled by state-owned enterprises. They are able to exercise complete control over the supply of technology, goods and services, as well as media and political messaging.

In some cases, autarky can allow a country to achieve rapid economic and political development. For example, during much of the 20 century China acted as an autarkic. During this period, China was able to reduce poverty significantly and has since moved towards more economic and financial cooperation.

However, in other cases, such as North Korea and Venezuela, autarky has resulted in a gradual loss of economic and political development within the country.

Hegemony

Hegemonic countries tend to be regional or even global leaders, who use their political or economic influence over others to control resources. A hegemonic system can benefit both the hegemonic countries themselves and the international system.

The economic and political dominance of a hegemon may provide it the ability to significantly influence global affairs. Countries that follow the hegemon’s rules and standards may reap the benefits provided by the leader, including the stabilizing force of monitoring and enforcing the hegemon’s standards.

However, hegemonic systems also have costs. Hegemons may become more competitive as they gain or lose influence, increasing the likelihood of geopolitical risk.

Example of hegemonic countries include the United States and Russia.

Multilateralism

Multilateralism refers to countries that participate in mutually beneficial trade relationships and extensive rule harmonization. Private firms are fully integrated into global supply chains with multiple trade partners.

Examples of multilateral countries include Germany and Singapore.

Factors that have led Singapore to rely heavily on globalization to achieve economic success are:

- Factor endowment: Limited natural resources, including water and arable land. This makes it highly dependent on trade partners and innovation to survive.

- Geographic location: Located at the intersection of many important global trade routes which helps make it an Asian center for world business.

- Cultural factors: Population is highly ethnically and racially diverse, fluent in English and highly skilled.

- Institutional factors: Highly stable political institutions with high governmental priorities on promoting economic activity and enforcing business-friendly institutional governance. This makes it a preferred investment destination and an attractive trade partner.

Bilateralism

Bilateralism is the conduct of political, economic, financial, or cultural cooperation between two countries. Countries that engage in bilateralism may have relations with many different countries, but these are one-at-a-time agreements without multiple partners.

Countries typically exist on a spectrum between bilateralism and multilateralism. Between the two extremes is regionalism, which involves a group of countries collaborating with one another. For example, regional blocs may agree to provide trade benefits to one another while raising barriers for those outside the group.

Japan once fit the description of bilateralism perfectly. Its government engaged in significant political cooperation in order to develop a strong export market, but it did not globalize its imports. However, today Japan would be considered a multilateral player.

The Tools of Geopolitics

Geopolitical tools can be classified into three types:

- National security tools

- Economic tools

- Financial tools

The use of various national security, economic, or financial tools may indicate that an actor’s character is changing, which may increase or decrease geopolitical risk.

National Security Tools

National security tools are those used to influence or coerce a state actor through direct or indirect impact on the country’s resources, people, or borders. National security tools may be active (in use at the time of analysis), or threatened (likely to be used in near future).

Armed conflict is the most extreme example of a national security tool. It is a direct and active national security tool that can have two major consequences:

- Destruction of physical infrastructure, which can have a long-term impact on a country’s capital stock and ability to rebuild that stock.

- Migration away from areas of armed conflict, which has the potential to alter international flows of goods, services, capital, and labor. It may also impact neighboring countries and states that accept refugees.

Espionage (the practice of using spies to obtain political or military information) is an indirect national security tool. Miliary alliances which are frequently used to either aid in direct conflict or to prevent conflict from occurring in the first place.

North Atlantic Treaty Organization (NATO), an alliance between the European Union, United States, United Kingdom, and Canada which was originally constructed to provide collective security against the Soviet Union, is now used to discuss and de-escalate potential conflict among members and between members and outside states.

Economic Tools

Economic tools are the actions used to reinforce cooperative or non-cooperative stances via economic means.

Examples of cooperative economic tools include multilateral trade agreements (such as Southern Common Market – MERCOSUR, which facilitates trade among member countries in South America) and the global harmonization of tariff rules (as facilitated by the World Trade Organization, WTO).

Examples of non-cooperative economic tools include

- Nationalism (the process of transferring an activity or industry from private to state control)

- Voluntary export restraints (refusing to trade as much of their goods and services as would meet demand)

- Imposing domestic content requirement (stating that a certain proportion of domestic input be included in an exported good)

Financial Tools

Financial tools are the actions used to reinforce cooperative or non-cooperative stances via financial mechanisms.

Examples of cooperative financial tools include the free exchange of currencies across borders and allowing foreign investment.

Examples of non-cooperative financial tools include limiting access to local currency markets and restricting foreign investment.

Cooperative financial tools that encourage cooperation in security, economic, and financial arenas may reduce geopolitical risk. However, if the system becomes too dependent on a particular financial tool, it may introduce vulnerabilities in the international system that can have far-reaching consequences.

Transactions in the international interbank market are heavily denominated in US dollars. While the market itself represents a form of cooperation, over reliance on the US dollar makes other countries vulnerable to changes in the US monetary policy.

Multifaceted Approaches

The national security, economic, and financial geopolitical tools discussed above can be intertwined. An example is cabotage which refers to the right to transport passengers or goods within a country by a foreign firm.

Many countries, including those with multilateral trade agreements, impose cabotage restrictions across transportation subsectors. This means that shippers, airlines, and truck drivers are not permitted to transport goods and services within the borders of another country. Allowing cabotage requires multilateral coordination in areas such as physical security and economic coordination.

Geopolitical Risk and Comparative Advantage

Geopolitical risk and tools of geopolitics can affect the comparative advantage of a country. Countries with low geopolitical risk may attract more labor and capital. Whereas, countries with high geopolitical risk may suffer a loss of labor and capital.

Germany’s reaction to the Syrian refugee crisis is an example of comparative advantage stemming from geopolitical risk.

Germany was able to resettle one million Syrian refugees due to its strong economic position in the EU and long-standing political stability. By adding young and talented migrants, Germany’s long-term demographic balance has improved which can potentially increase its economic growth rate.

Geopolitical Risk and the Investment Process

The degree to which investors consider geopolitical risk in their decision-making will vary widely depending on their investment objectives and risk tolerance. Some investors may not consider geopolitical risk separately, whereas others may make geopolitical risk a central component of their investment strategy.

Types of Geopolitical Risk

The three basic types of geopolitical risk are:

- Event risk: Event risk evolves around set dates, such as elections, new legislation, or other date-driven milestones, such as holidays or political anniversaries, known in advance. Political events often cause investors to change their expectations about a country’s cooperative stance.

- Brexit is an example of event risk.

- Exogenous risk: Exogenous risk is a sudden or unanticipated risk that impacts either a country’s cooperative stance, the ability of non-state actors to globalize, or both.

- Examples include sudden uprisings, invasions, or the aftermath of natural disasters.

- Thematic risk: Thematic risks are known risks that evolve and expand over a period of time.

- Examples include climate change, cyber threats, and the ongoing threat of terrorism.

Assessing Geopolitical Threats

To assess geopolitical threats, an investor considers geopolitical risk in terms of the following three areas:

- Likelihood it will occur: Refers to the probability that a risk will occur. Measuring the likelihood is a challenging process and this exercise can be more art than science.

- Velocity (speed) of its impact: Refers to the pace at which a risk may impact an investor’s portfolio.

- Short-term or high velocity impacts: Exogeneous or

black swan(an event that is rare and difficult to predict but has a significant impact) events fit this category. Such events cause market volatility and investor flight to quality in the short term. But long-term changes may not be required. - Medium-term impacts: Risks with medium term impact may affect a company’s process, costs, and investment opportunities, resulting in lower valuations. These risks tend to impact some companies/sectors more than others.

- Long-term or low velocity impacts: Long-term risks may have significant ESG impacts requiring an adjustment to an investor’s long term asset allocation. However, they may have limited immediate impact on portfolios.

- Short-term or high velocity impacts: Exogeneous or

- Size and nature of that impact: A risk’s impact on a portfolio can manifest in many different ways. Generally, investors are more concerned with risks that have a high impact and may ignore risks that have a low-impact.

Also, the size of a risk’s impact can be magnified by external factors. For example, risk tends to have a greater impact on markets experiencing an economic downturn.

Impacts may be discrete (affecting only one company/sector) or broad (affecting the entire economy) in nature.

Cyber risks can have both discrete and broad impacts. In the event of a cyberattack, the specific company will be impacted. It will also impact all other companies by increasing their monitoring, due diligence, and security costs.

Geopolitical risks rarely evolve in a linear fashion, which makes it difficult to forecast their likelihood, velocity, size and nature of impact on a portfolio. Therefore, instead of using a single point forecast, many investors use a scenario building and signposting approach.

Scenario analysis is the process of comparing portfolio outcomes across different scenarios or states of the world. Scenarios can be qualitative, quantitative, or a combination of the two.

Tracking Risks According to Signposts

A signpost is an indicator, market level, data piece, or event that signals a risk is becoming more or less likely. We can think of signposts like a traffic light.

- If the risk is low in likelihood, velocity, or impact then the signposts are flashing ‘green’ indicating ‘no action needed’.

- If the risk is medium in likelihood, velocity, or impact then the signposts are flashing ‘amber’ indicating ‘higher caution and preparedness’.

- If the risk further rises in likelihood, velocity or impact then the signposts are flashing ‘red’ indicating ‘an action plan is necessary’.

BREXIT

Before 2014, the signposts for geopolitical risk in the UK may have flashed green. When the referendum was announced in 2015, the signposts flashed amber. In May 2016, when phone polls suggested that the “leave” vote was gaining majority, the signposts flashed red.

Manifestations of Geopolitical Risk

High-velocity risks are most likely to manifest themselves in market volatility through sudden changes in asset prices.

In response to the COVID-19 pandemic, the S&P 500 index declined nearly 34%. Also, investors flight to safety pushed up US bond prices and the US 10-year treasury yield declined by nearly 68%. Note, however that this impact was not permanent and the markets eventually recovered.

Low-velocity geopolitical risks can have a more prolonged impact. Sustained disruption can lead to lower revenues, higher costs, or both, all of which can have a negative impact on a company’s valuation.

Investors may require higher compensation for countries, regions, or sectors perceived to be at higher risk of geopolitical disruption, effectively increasing the discount rate investors use when valuing those securities. This is a key reason why investors demand a higher required return for investments in emerging and frontier markets as compared to developed markets.

Acting on Geopolitical Risk

On a macroeconomic level, geopolitical risks can impact capital market conditions, such as economic growth rates, interest rates, and market volatility. This in turn can influence the asset allocation decisions of investors.

Geopolitical risks can also influence the amount of capital an investor allocates to different countries.

For example, more capital will be allocated to countries with a long history of using a multilateral approach and less capital will be allocated to countries experiencing consistent military threat.

On a portfolio level, investors can consider geopolitical risk as one of the factors in a multi-factor model. Geopolitical risk can influence the appropriateness of an investment security or strategy for an investor’s goals, risk tolerance, and time horizon.

For example, an investor with low risk tolerance should reduce exposure to geopolitical risk through low-volatility investment choices or through hedging.