Go to Economics

Topics

Table of Contents

Introduction

- Benefits and costs of international trade

- Types of trade restrictions and their economic implications

- Trading blocs and regional integration

Benefits and Costs of Trade

Benefits of International Trade

- Countries gain from the exchange and specialization. A country benefits from exchange trade if either of the following two conditions occur in an exchange, (as there is efficient allocation of resources):

- Higher price for exports relative to selling internally.

- Lower price for imports relative to producing internally.

- Households and firms have greater product variety.

After South Korean electronics manufacturers such as LG and Samsung entered the South Asian markets, consumers benefited because they had access to a wide range of products.

- Competition increases and resources are allocated more efficiently.

- In an open economy, increased competition from foreign forms reduces the monopoly power of domestic firms and forces them to be efficient.

- By increasing production of the exported good and reducing production of the imported good, a country achieves a more efficient allocation of resources. This efficiency enables the consumption of a larger basket of goods, increasing overall welfare.

- Industries experience greater economies of scale.

- In an open economy, companies are forced to compete with global players and that forces them to become more efficient or go out of business.

- Greater employment in exporting countries.

The garment factories in Bangladesh export cotton clothing to the rest of the world for various labels. The work in this industry is labor-intensive and hence generates a lot of employment opportunities.

Note: The term “gains from trade” implies that the overall benefits of trade outweigh the losses from trade. It does not mean that all stakeholders (producers, consumers, government) benefit (or benefit equally) from trade.

Costs of International Trade

- Potential income inequality.

- It depends on whether the industry is expanding or contracting.

IT industry in the late 90’s and early 2000’s created high-paying jobs. This led to an income disparity between the IT industry and other traditional industries such as automobiles.

- Loss of jobs because less inefficient firms will be forced to exit.

U.S. textile industry has faced tough competition because of cheaper imports from other countries forcing many companies to exit.

Trade Restrictions and Agreements—Tariffs, Quotas, and Export Subsidies

Trade restrictions are government policies that limit the ability of domestic households and firms to freely trade with other countries.

Tariffs

Tariffs are taxes imposed by a government on imported goods. Tariffs are common in countries where the government finds it difficult to collect taxes from its citizens.

Why governments levy tariffs:

- To protect domestic industries.

- To reduce trade deficit. Tariffs reduce the demand for imports by increasing their price above the free trade price.

“Small” country: A country is a price taker in the world market for a product, and is too small to affect the world market price. For example, India is a price taker for luxury bikes like Ducati, Harley Davidson, and Triumph.

“Large” country: A country is a large importer of the product and can influence the world market price. For example, the United States is a large country for the automobile market. If it were to impose tariffs on imported cars, then exporters would reduce the price of the cars to retain market share.

Generally, tariffs result in loss in global welfare.

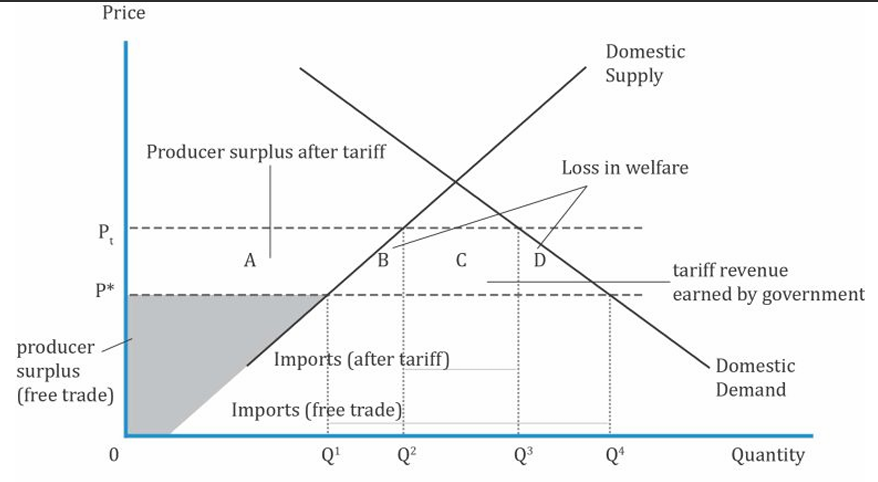

Welfare effects of Tariff and Import Quota

- Under free trade:

is domestic supply and is domestic consumption. - Import demand = Demand – Supply = Distance b/w

and - Assume the country is Portugal, and it imports cars. It is a price taker and the price per car (P*) is 100.

- After tariff is imposed:

is domestic supply and is domestic consumption. - Import demand = Distance b/w

and - Domestic producers supply more and consumers demand less. The price is represented by

. - Assume Portugal imposes a 50% tariff, so the price of the car is now 150.

Interpretation of what happens after the tariff:

- Tariff results in a deadweight loss, known as welfare loss here, denoted by B + D.

- Producer surplus increases to A because of a higher price for their output.

- Government revenue increases because of the tariff collected, as denoted by C.

- Consumer surplus decreases because of the increase in price.

| Importing Country | |

|---|---|

| Consumer surplus | - (A + B + C + D) |

| Producer surplus | + A |

| Tariff revenue | + C |

| National welfare | - (B + D) |

If the U.S. imposes a tariff, then Japan will reduce the price of cars. Terms of trade for the U.S. will improve as the price of imports has gone down.

The outcome is:

- For the importing country (US): producers gain, but consumers lose. Creates tariff revenue for the government.

- For the exporting country (Japan): producers lose but consumers gain.

South Africa manufactures 110,000 tons of paper. However, domestic demand for paper is 200,000 tons. The world price for paper is USD 5 per ton. South Africa will import 90,000 tons of paper from the world market at free trade prices. If the South African government (a small country) decides to impose a tariff of 20 percent on paper imports, the price of imported paper will increase to USD 6. Domestic production after the imposition of the tariff increases to 130,000 tons, while the quantity demanded declines to 170,000 tons.

- Calculate the loss in consumer surplus arising from the imposition of the tariff on imported paper.

The loss in consumer surplus = 1 × 170,000 + 1/2 × 1 × 30,000 = 185,000 (A + B + C + D)

- Calculate the gain in producer surplus arising from the imposition of the tariff.

Gain in producer surplus = 1 × 110,000 + 1/2 × (1 × 20,000) = 120,000 (A)

- Calculate the gain in government revenue arising from the imposition of the tariff.

Change in government revenue = 1 × 40,000 = 40,000 (C)

- Calculate the deadweight loss arising from the imposition of the tariff.

Deadweight loss because of the tariff = 1/2 × 1 × 20,000 + 1/2 × 1 × 30,000 = 25,000 (B + D)

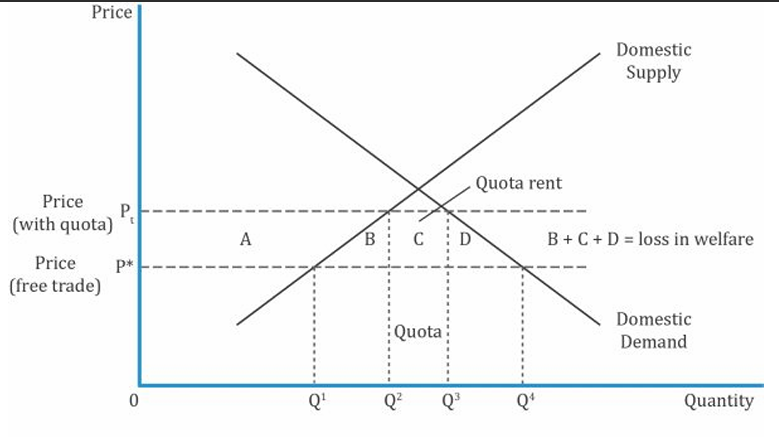

Quotas

Quota is a restriction on the absolute amount (quantity) of imports allowed over some period, typically a year. An import license specifies the maximum quantity that can be imported during a given period; it is used to implement a quota.

Quota rents: The extra profit earned by foreign producers. Exporters earn greater profits with quotas because they often raise the price of their goods.

Welfare effects of Tariff and Import Quota

Interpretation:

- With tariffs, it was clear that region C was the revenue earned by the government. But, in the case of quota, these are profits earned by the exporters as they raise the prices of their goods. If there was no quota, the prices of these goods would not have increased.

- With tariffs, the loss in welfare was equal to the deadweight loss of B+D. But, with quotas, it is equal to B+C+D. The amount lost in C can be eliminated if the government sells the import licenses to the exporters for a fee, and this amount must be equal to C.

Voluntary export restraint: Export quota administered by the exporting country; exporting country agrees to limit exports of a particular good usually at the request of the importing country to avoid tariffs or quotas. A VER allows importing countries to protect domestic industries from a surge of imports.

The difference between an import quota and a VER is that the former is imposed by the importing country, while the latter is imposed by the exporter.

One example of a VER is between Japan and U.S. from 1981 to 1994. The U.S. recognized the rising popularity of Japan’s cars in the early 1980s and wanted to protect its domestic automobile industry. In 1981, the Japanese government responded by entering into a VER agreement with the US limiting the number of cars exported to the United States to 1.68 million a year.

Export Subsidies

Export subsidies are payments by the government to a firm for each unit exported:

- The objective is to stimulate exports, increase production in certain industries, and create domestic employment.

- The exporter has an incentive to focus on the export market because the firm receives the international price plus the per-unit subsidy for each unit of the good exported.

- The most export-subsidized industry in the world is agriculture.

- Countervailing duties are duties levied by the importing country against subsidized exports entering the country. This tariff is imposed to offset the effect of subsidy.

- If a small country imposes export subsidies, domestic price rises.

- If a large country imposes export subsidies, world prices decline as quantity increases.

- For example, the European Union subsidizes sugar and is the second largest exporter in the world.

- Net welfare is down in the large and small country.

Effects of Alternative Trade Policies on Price, Production, Consumption, and Trade

| Tariff | Import Quota | Export Subsidy | VER | |

|---|---|---|---|---|

| Impact on | Importing country | Importing country | Exporting country | Importing country |

| Government revenue | Increases | Mixed (Quota rents are captured by importing country through sale of licenses, or by exporters) | Falls (Spending rises) | No change (Rent to foreigners) |

| National welfare | Could increase in large country | Could increase in large country | Decreases | Decreases |

| Trade | Imports ↓ | Imports ↓ | Exports ↑ | Imports ↓ |

- Domestic consumption, consumer surplus decreases.

- Domestic production, producer surplus and price increases.

Thailand, a small country, has to decide whether to impose a tariff or a quota on the import of computers. You are considering investing in a local firm that is a major importer of computers.

- What will be the impact of a tariff on prices, quantity produced, and quantity imported in Thailand (the importing country)?

A tariff imposed by a small country, such as Thailand, raises the price of computers in the importing country, reduces the quantity imported, and increases domestic production.

- If Thailand imposes a tariff, what will the impact be on prices in the exporting country?

A tariff imposed by a small country would not change the price of computers in the exporting country.

- How would a tariff affect consumer surplus, producer surplus, and government revenue in Thailand?

When a small country imposes a tariff, it reduces consumer surplus, increases producer surplus, and increases government revenue in that country

- Explain whether the net welfare effect of a tariff is the same as that of a quota.

The quota can lead to a greater welfare loss than a tariff if the quota rents are captured by the foreign government or foreign firms.

- Which policy, a tariff or a quota, would be most beneficial to the local importer in which you may invest and why?

A tariff will hurt importers because it will reduce their share of the computer market in Thailand. The impact of a quota depends on whether or not the importers can capture a share of the quota rents. Assuming importers can capture at least part of the rents, they will be better off with a quota.

- If Thailand were to negotiate a VER with the countries from which it imports computers, would this be better or worse than an import quota for the local importing firm in which you may invest? Why?

The VER would not be better for the local importer than the import quota and would most likely be worse. Under the VER, all of the quota rents will be captured by the exporting countries whereas with an import quota at least part of the quota rents may be captured by local importers.

Trading Blocs and Regional Integration

A regional trading bloc, is an agreement between a group of countries, that are geographically close to each other, to reduce and eliminate barriers to trade and movement of factors of production among the members of the bloc. They have zero or very low tariffs on imports from members.

Types Of Trading Blocs

The diagram below shows the various types of regional trading blocs in an increasing order of integration.

| Free Trade Area | No trade restrictions with members; own policy with non members. | NAFTA agreement b/w US, Mexico and Canada |

| Customs Union | Common trade policy against non members. | Belgium, Netherlands, Luxembourg (1948) |

| Common Market | Free movement of labor and capital (factors of production) goods among member countries. | Southern cone of Argentina, Brazil, Paraguay and Uruguay |

| Economic Union | Common economic institutions and economic policies (monetary and fiscal) among member countries. | EU of 28 countries |

| Monetary Union | When members of economic union decide to adopt a single common currency | Euro adopted by 18 of the members of EU. |

Regional Integration

Regional integration is popular because removing trade and investment barriers among a small group of countries is easier, politically less contentious, and faster than multilateral trade negotiations under the World Trade Organization. (WTO).

Regional integration results in preferential treatment for members over non-members and can cause changes in trade patterns.

- Trade creation occurs when regional integration results in the replacement of higher-cost domestic production by lower-cost imports from other members.

- Trade diversion occurs when lower-cost imports from non-member countries are replaced with higher-cost imports from members.

Challenges to Deeper Integration:

There are at least two challenges to moving from an FTA to deeper levels of integration.

- Cultural and historical considerations, such as wars and conflicts, may complicate the integration process.

- A high level of economic integration limits member countries’ ability to pursue independent economic and social policies