Go to Quantitative Methods

Topics

Table of Contents

Introduction

- Present value (PV): The money today is called the present value. This could be an investment which you make at time 0.

- Future value (FV): The value at a future point in time is called the future value.

- Interest rate (I): The link between present value and future value is established through an interest rate.

$100 is the PV.

$110 is the FV. (After 1 year)

Then, the Interest Rate is 10%.

Interest Rates and Time Value of Money

Interest rates can be interpreted as:

- Required rate of return: Will to give money today on the condition that you get more after one year.

- Discount rate: Discount the money that you will receive after one year to get the present value.

- Opportunity cost: If instead of lending, you spend it on something else, then you have forgone the opportunity to earn interest.

Determinants of Interest Rates

As an investor, we can think of the interest rate as a sum of the following components:

Interest Rate = Real Risk-Free Interest Rate + Inflation Premium + Default Risk Premium + Liquidity Premium + Maturity Premium

- Real risk-free interest rate: Rate that you get on a security that has no risk and is extremely liquid. Assume: No Inflation

- Inflation premium: Expected annual inflation in the upcoming period.

- Default risk premium: Additional premium that investors require because of the risk of default.

Let’s say that you lend $100 each to person A and person B. However, B has a high risk of default, so you are worried that he might not pay. Therefore you might demand a higher return from B as compared to A, because of the risk of default. This additional return that you demand is called the default risk premium.

- Liquidity premium: Compensates investors for the risk of receiving less than the fair value for an investment if it must be converted to cash quickly.

Think of two investments C and D which are similar in all regards. The only difference is that investment C is extremely liquid, whereas investment D is not that liquid. Clearly as investors, we will demand a higher return on D because it is not easy to sell. This additional return that we demand is called the liquidity premium.

- Maturity premium: Investors demand on a security with long maturity. The maturity premium compensates investors for the increased sensitivity of the market value of debt to a change in market interest rates as maturity is extended.

Let’s say we have two securities, E and F. Security E has a maturity of 1 year and security F has a maturity of 4 years. Because of the longer maturity, F has more risk, in terms of its price being more sensitive to changes in interest rate.

Nominal Risk Free Rate

| Investments | Maturity | Liquidity | Default Risk | Interest Rate |

| ----------- | -------- | --------- | ------------ | ------------- |

| A | 1 | High | Low | 2 |

| B | 1 | Low | Low | 2.5 |

| C | 2 | Low | Low | r |

| D | 3 | High | Low | 3 |

| E | 3 | Low | High | 4 |

- Why A and B rates are different?

- Estimate default risk premium.

- Calculate upper and lower limits for r.

- B has lower liquidity than A → The difference is the liquidity premium.

- Lower Liquidity version of D = 3 + 0.5 = 3.5

- New D has lower default risk than E → The difference is default risk premium.

- C has longer maturity than B.

- C is low liquidity version of D.

Rates of Return

A financial asset’s total return consists of two components: income and capital appreciation.

Holding Period Return

Holding period return (HPR) is the return that an investor earns over a specified holding period.

The formula for calculating HPR for an investment that makes one-time cash payment at the end of the holding period is given below:

is initial investment. is price received at the end of period. is cash paid by investment at the end of holding period.

Assume we buy a stock for $50. Six months later, the stock price goes up to $53 and we receive a dividend of $2. Calculate the holding period return.

Holding period return can be computed for a period longer than a year. HPR for three annual returns is calculated as:

Annual returns of mutual fund are 20%, -8%, -1%. Find the HPR.

Arithmetic or Mean Return

A drawback of the arithmetic mean is that it is sensitive to extreme values (outliers). It can be pulled sharply upward or downward by extremely large or small observations, respectively.

- Option 1: Do nothing; use the data without any adjustment → If extreme values are genuine.

- Option 2: Delete all the outliers → If observations are extreme. Trimmed mean of the remaining values.

- Option 3: Replace the outliers with another value (observations closest to them) → Winsorized mean assigns a % of the lowest values equal to one specified low value and a % of the highest values equal to one specified high value, and then computes the mean.

Geometric Mean Return

A less tested formula is:

P/E ratio of a stock over past 4 years: 10, 15, 14, 13. Geometric mean P/E:

- The geometric mean is appropriate to measure past performance over multiple periods.

- The arithmetic mean is appropriate for forecasting single period returns.

The portfolio returns for the past two years were 100% in year 1 and -50% in year 2. What was the mean return?

Two possible returns for the next year are 100% and -50%. What is the expected return?

The Harmonic Mean

The harmonic mean is used to find average purchase price for equal periodic investments.

An investor purchases $1,000 of a security each month for three months. The share prices are $10, $15 and $20 at the three purchase dates. Calculate the average purchase price per share for the security purchased.

- If returns are constant over time: AM = GM = HM

- If returns are variable: AM > GM > HM

- The greater the variability of returns over time, the more the AM will exceed the GM

Which Mean to Use?

- Arithmetic mean: Should be used with single period or cross-sectional data.

- Geometric mean: Should be used with time-series data.

- Harmonic mean: Should be used to find average purchase price for equal periodic investments.

- Trimmed mean: Should be used when the data has extreme outliers.

- Winsorized mean: Should be used when the data has extreme outliers.

Money-Weighted and Time-Weighted Return

Internal Rate of Return

The internal rate of return (IRR) is the discount rate that makes the net present value of an investment equal to zero. It is internal because it depends only on the cash flows of the investment; no external data is needed.

The formula for IRR is as follows:

= Expected net cash flow at time t - NPV = Net present value of the investment

- IRR = Internal rate of return

The IRR is a single number which represents the return generated by an investment.

Consider an initial investment of $150,000. Estimated cash flows for the following three years from this investment are $50,000, $100,000 and $40,000 respectively. What is the IRR?

Solving with a financial calculator, we get a rate of 13.11%

Money-Weighted Rate of Return

The money-weighted rate of return is the internal rate of return (IRR) of an investment.

- t = 0, buy a share for $20

- t = 1, receives a dividend of $0.5 and purchases another share for $22.5.

- t = 2, sells both shares for $23.5 each after receiving another dividend of $0.5 per share.

What is the money-weighted return?

| Time | Outflow | Inflow | Net Cash Flow |

|---|---|---|---|

| 0 | Purchase share 1 = -20 | ||

| 1 | Purchase share 2 = -22.5 | Dividend on share 1 = 0.5 | |

| 2 | Dividend on shares = 0.5 x 2 Sale of shares = 47 |

||

| Calculator’s IRR function finds the money-weighted rate of return as 9.39% |

Time Weighted Rate of Return

The time-weighted rate of return measures the compound growth rate of $1 initially invested in the portfolio over a stated measurement period.

Steps

- Break the overall evaluation period into sub-periods based on the dates of cash inflows and outflows.

- Calculate the holding period return on the portfolio for each sub-period.

- Link or compound holding period returns to obtain an annual rate of return for the year (the time-weighted rate of return for the year).

- If the investment is for more than a year, take the geometric mean of the annual returns to obtain the time-weighted rate of return over that measurement period.

For the same problem,

Step 1

At the start of year 1, value is 20.

At the end of year 1, value is 22.5 + 0.5 = 23.

At the start of year 2, value is 22.5 + 22.5 = 45.

At the end of year 2, value is 23.5 + 23.5 + 0.5 + 0.5 = 48.

Dividend of share 1 received at the end of year 1 → Not considered part of portfolio after that.

Step 2

No sub periods

Step 3

Year 1: 20 → 23 (HPR = 15%)

Year 2: 45 → 48 (HPR = 6.67%)

Step 4

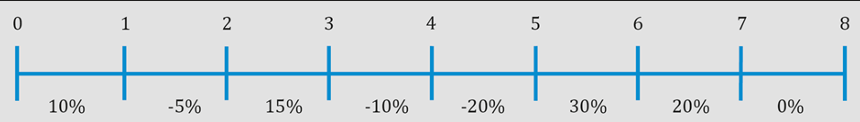

Consider an investment where cash flows occur at the start/end of every quarter. Here each quarter is considered a sub-period. The return for each sub-period has already been calculated and is shown below:

Step 3: Link the quarterly returns to determine the return for Years 1 and 2 respectively

Year 1: $$(1+0.1)(1-0.05)(1+0.15)(1-0.1)=1.0816$$

Year 2: $$(1-0.2)(1+0.3)(1+0.2)(1+0)=1.2480$$

Step 4: $$TWRR=(1.0816\times1.2480)^{\frac{1}{2}}-1=0.1618$$

Money Weighted v/s Time Weighted Returns

- The money-weighted rate of return is impacted by the timing and amount of cash flows.

- The time-weighted rate of return is not impacted by the timing and amount of cash flows.

- The time-weighted return is an appropriate performance measure if the portfolio manager does not control the timing and amount of investment.

- On the other hand, money-weighted return is an appropriate measure if the portfolio manager has control over the timing and amount of investment.

Annualized Return

Annual Compounding

Say, present value (PV) = $100 and interest rate (r) = 10%.

- What is the future value (FV) after one year?

- What is the future value (FV) after two years?

The future value of a single cash flow with annual compounding can be computed using the following formula:

- FV = Future value of the investment

- N = Number of periods

- PV = Present value of the investment

- r = Rate of interest

Therefore,

Notice that with compound interest, after two years we have $121. Whereas, with simple interest, after two years we would have $120. The difference between the two values ($1) represents the interest on interest component.

If the value for PV is negative “-”, then the value for FV is positive “+”. An inflow is often represented as a positive number, while outflows are denoted by negative numbers.

Non-Annual Compounding

When our compounding frequency is not annual, we use the following formula to compute future value:

- r = Stated annual interest rate in decimal format

- m = Number of compounding periods per year

- N = Number of years

Donald invested $3 million in an American bank that promises to pay 4% compounded daily. Which of the following is closest to the amount Donald receives at the end of the first year? Assume 365 days in a year.

- $3.003 million

- $3.122 million

- $3.562 million

Annualizing Returns

Annualized return converts the returns for periods that are shorter or longer than a year, to an annualized number for easy comparison.

Q1) If the one-week holding period return is 4%, then the equivalent continuously compounded return is: ln(1 + 0.04) = 3.922%

Q2) A stock was purchased at t = 0 for 30. One period later at t = 1, the stock has a value of 34.50. The continuously compounded return over the period can be calculated as:

Other Major Return Measures and Their Applications

Gross Return

Gross return is the return earned by an asset manager prior to deducting management fees and taxes. It measures the investment skill of a manager.

Net Return

Net return is the return earned by the investor on an investment after all managerial and administrative expenses have been accounted for. This is the measure of return that should matter to an investor.

Assume an investment manager generates $120 for every $100, and charges a 2% fee for management and administrative expenses. The gross return, in this case, is 20% and the net return is 18%.

Pre-Tax and After-Tax Nominal Return

The returns we saw till now were pre-tax nominal returns, i.e., before deducting any taxes or any adjustments for inflation. This is the default, unless otherwise stated.

After-tax nominal return is the return after accounting for taxes. The actual return an investor earns should consider the tax implications as well.

In the example that we saw above for gross and net return, 18% was the pre-tax nominal return. If the tax rate for the investor is 33.33%, then the after-tax nominal return will be 18(1 – 0.3333) = 12.0006%.

Real Return

Real return is the return after deducting taxes and inflation.

= Real rate = Rate of inflation - r = Nominal rate

In the previous example, the after-tax nominal return was 12%. Assume the inflation rate for the period is 10%. What is the real rate of return?

Using the above formula, (1 + 0.12) = (1 + r) (1 + 0.1). Solving for r, we get 1.818%.

Leveraged Return

In cases, where an investor borrows money to invest in assets like bonds or real estate, the leveraged return is the return earned by the investor on his money after accounting for interest paid on borrowed money.